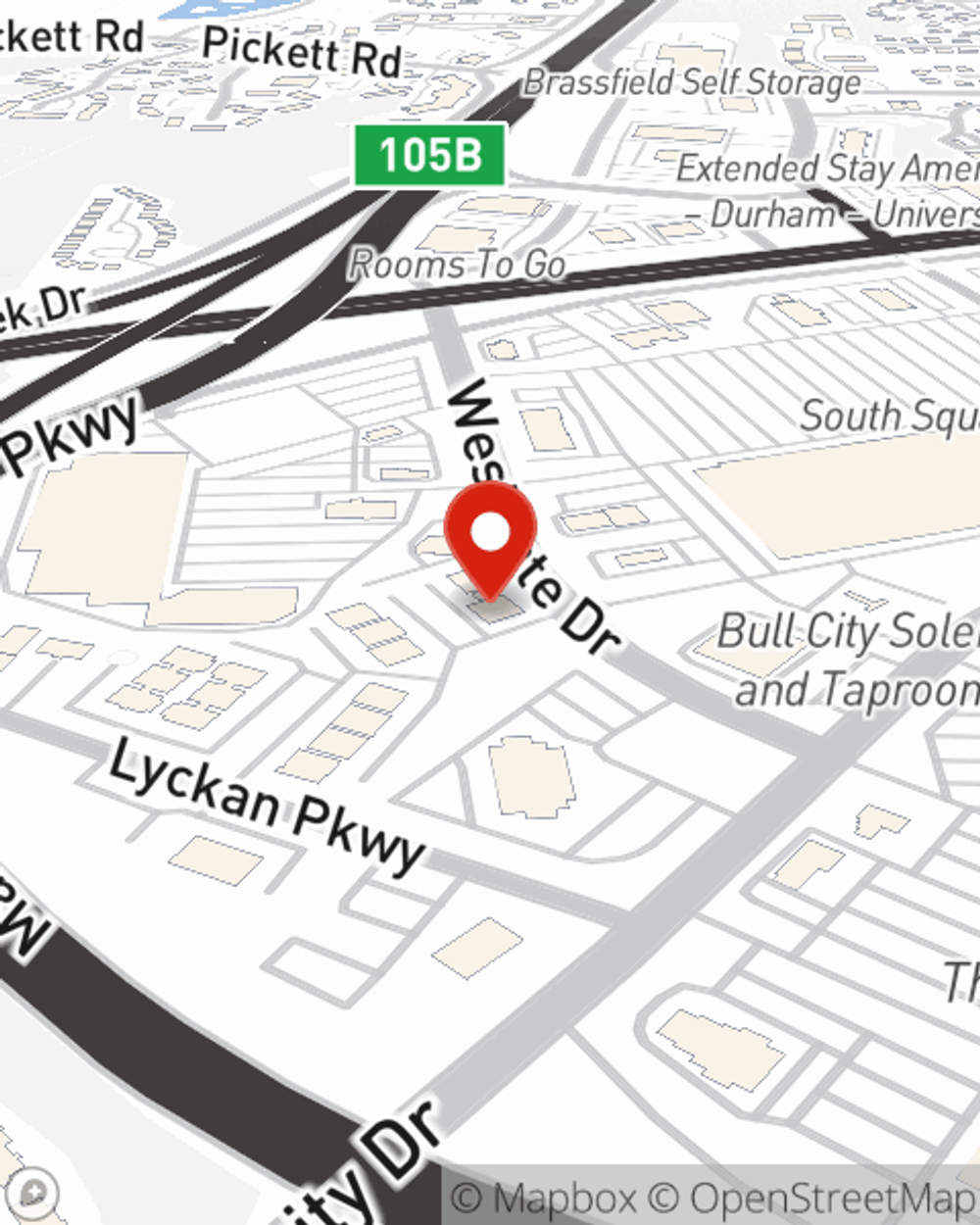

Life Insurance in and around Durham

Protection for those you care about

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Durham NC

- Chapel Hill, NC

- Raleigh, NC

- Duke University

- UNC

- Hope Valley

- Research Triangle

- RTP

- Wake County, NC

- Durham, County

- Orange County, NC

- Pittsboro, NC

- Hillsboro, NC

- Wake Forest, NC

- Winston-Salem, NC

- Apex, NC

- Mebane, NC

- Holly Springs, NC

- Carrboro, NC

- Graham , NC

- Burlington, NC

- Sanford, NC

- Morrisville, NC

- Bull City

It's Never Too Soon For Life Insurance

There's a common misconception that Life insurance is only needed when you get older, but even if you are young and a recent college graduate, now could be the right time to start learning about Life insurance.

Protection for those you care about

Life won't wait. Neither should you.

Durham Chooses Life Insurance From State Farm

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific time frame level or flexible payments with coverage to last a lifetime or another coverage option, State Farm agent James Zewe can help you with a policy that's right for you.

If you're a person, life insurance is for you. Agent James Zewe would love to help you explore the variety of coverage options that State Farm offers and help you get a policy that's right for you and your loved ones. Contact James Zewe's office to get started.

Have More Questions About Life Insurance?

Call James at (919) 489-0804 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.